Are You Making These 7 Small Business Bookkeeping Mistakes? (And How Outsourcing Fixes Them Fast)

- Manish Sinha

- Feb 2

- 5 min read

Ever feel like your business finances are a mess, but you're too busy running the show to fix them? You're not alone. Most small business owners wear too many hats, and bookkeeping often gets pushed to the bottom of the to-do list: until tax season hits or cash flow problems emerge.

The truth is, DIY bookkeeping mistakes cost small businesses thousands of dollars each year in missed deductions, penalties, and lost time. But here's the good news: recognizing these errors is the first step toward fixing them. Even better? Outsourcing your small business bookkeeping to professionals eliminates these headaches entirely, giving you peace of mind and freeing up your time to focus on growth.

Let's dive into the seven most common bookkeeping mistakes that could be costing your business: and how outsourced bookkeeping services solve each one.

Mistake #1: Misclassified Transactions

You record an expense, but it ends up in the wrong category. That new computer? Logged as an expense instead of an asset. Sales tax accidentally posted as income. Sound familiar?

Misclassified transactions distort your profit and loss statements, making it impossible to understand your true financial position. When tax time arrives, these errors create a nightmare for your accountant and could trigger IRS scrutiny.

How outsourcing fixes it: Professional bookkeepers understand proper account mapping and maintain clean charts of accounts. They ensure every transaction lands in the right bucket: whether it's an expense, asset, or equity account. No more guesswork, no more confusion. Just accurate financial data you can trust.

Mistake #2: Broken or Incomplete Reconciliations

Your bank feed creates duplicate entries. Clearing dates don't match. You notice discrepancies but use "reconciliation adjustments" to make the numbers work instead of finding the real problem.

These shortcuts might seem harmless, but they create a house of cards. Your books won't align with your actual bank balances, making it impossible to trust your cash flow reports or financial statements.

How outsourcing fixes it: Outsourced bookkeepers perform systematic monthly bank reconciliations, catching discrepancies early and resolving them properly. They dig into the root causes of mismatches rather than papering over them with adjustments. This means your ledger always reflects reality, giving you confidence in your financial position.

Mistake #3: Mixing Personal and Business Finances

Using your business account for personal expenses? Paying business bills from your personal checking? This commingling creates serious problems beyond just messy records.

When personal and business finances mix, you face tax complications, legal vulnerabilities, and an impossible task tracking true profitability. Come audit time, sorting through transactions becomes a nightmare. Plus, you're putting your personal assets at risk if your business structure relies on that separation for liability protection.

How outsourcing fixes it: Professional bookkeepers maintain strict boundaries between personal and business finances. They ensure proper documentation of all transactions and can help you establish systems to keep everything separate from day one. This clarity protects you legally and makes tax filing straightforward.

Mistake #4: Inadequate Record-Keeping

Missing receipts. Unorganized invoices. That important document you swore you saved but can't find anywhere.

Poor record-keeping doesn't just create stress: it costs real money. You lose out on legitimate tax deductions because you can't prove the expense. You face compliance risks that could trigger penalties. And if the IRS comes knocking for that seven-year paper trail they require? You're in trouble.

How outsourcing fixes it: Outsourced bookkeeping teams implement systematic digital record-keeping from day one. They organize documents efficiently, maintain required backups, and ensure everything is audit-ready. No more shoebox full of receipts or frantic searches for documentation. Everything is properly filed, backed up, and accessible when you need it.

Mistake #5: Failing to Track Reimbursable Expenses

You pay for business expenses out of pocket, intending to track them later. Spoiler alert: "later" never comes. These untracked reimbursable expenses represent lost money and missed tax deductions that add up fast.

Maybe it's that client lunch you paid for personally, or the office supplies you grabbed on your way home. Each small expense seems insignificant, but collectively, they represent hundreds or thousands of dollars slipping through the cracks.

How outsourcing fixes it: Professional bookkeepers establish consistent expense-tracking processes that capture reimbursable expenses as they occur. They create systems ensuring nothing falls through the cracks, so you get reimbursed promptly and your business captures every legitimate deduction.

Mistake #6: Incorrect Employee Classification

Are your workers employees or independent contractors? Get this wrong, and you're facing steep IRS penalties and potential lawsuits.

Many business owners misclassify workers without realizing the legal and financial consequences. The IRS has specific rules about who qualifies as an independent contractor versus an employee, and violations can result in back taxes, penalties, and interest that devastate small businesses.

How outsourcing fixes it: Experienced bookkeepers understand classification rules inside and out. They ensure proper documentation from the start, protecting your business from costly compliance violations. If you're unsure about current classifications, they can review your situation and help you get compliant before problems arise.

Mistake #7: Improper Sales Tax Handling

Sales tax seems straightforward until you're selling across state lines or dealing with eCommerce complexities. Failing to properly collect and remit sales tax creates surprise tax liabilities that can seriously damage your cash flow.

The landscape gets even trickier with economic nexus rules that vary by state. You might have sales tax obligations in states where you've never set foot physically. Recording sales tax as income instead of a liability? That's another common error that inflates your revenue and creates a tax headache.

How outsourcing fixes it: Professional bookkeepers stay current on ever-changing tax laws and ensure accurate sales tax handling. They map sales tax correctly to liability accounts, track nexus requirements across states, and keep your business compliant: no surprise tax bills down the road.

How Mondial Financials Makes Bookkeeping Easy

At Mondial Financials, we understand the challenges small business owners face. That's why we've designed our bookkeeping services specifically for businesses under $2M in revenue: companies that need professional support without enterprise-level complexity or cost.

Our approach is simple: flat-fee monthly pricing that scales with your business, human support you can actually talk to, and comprehensive services that address all seven mistakes we've covered.

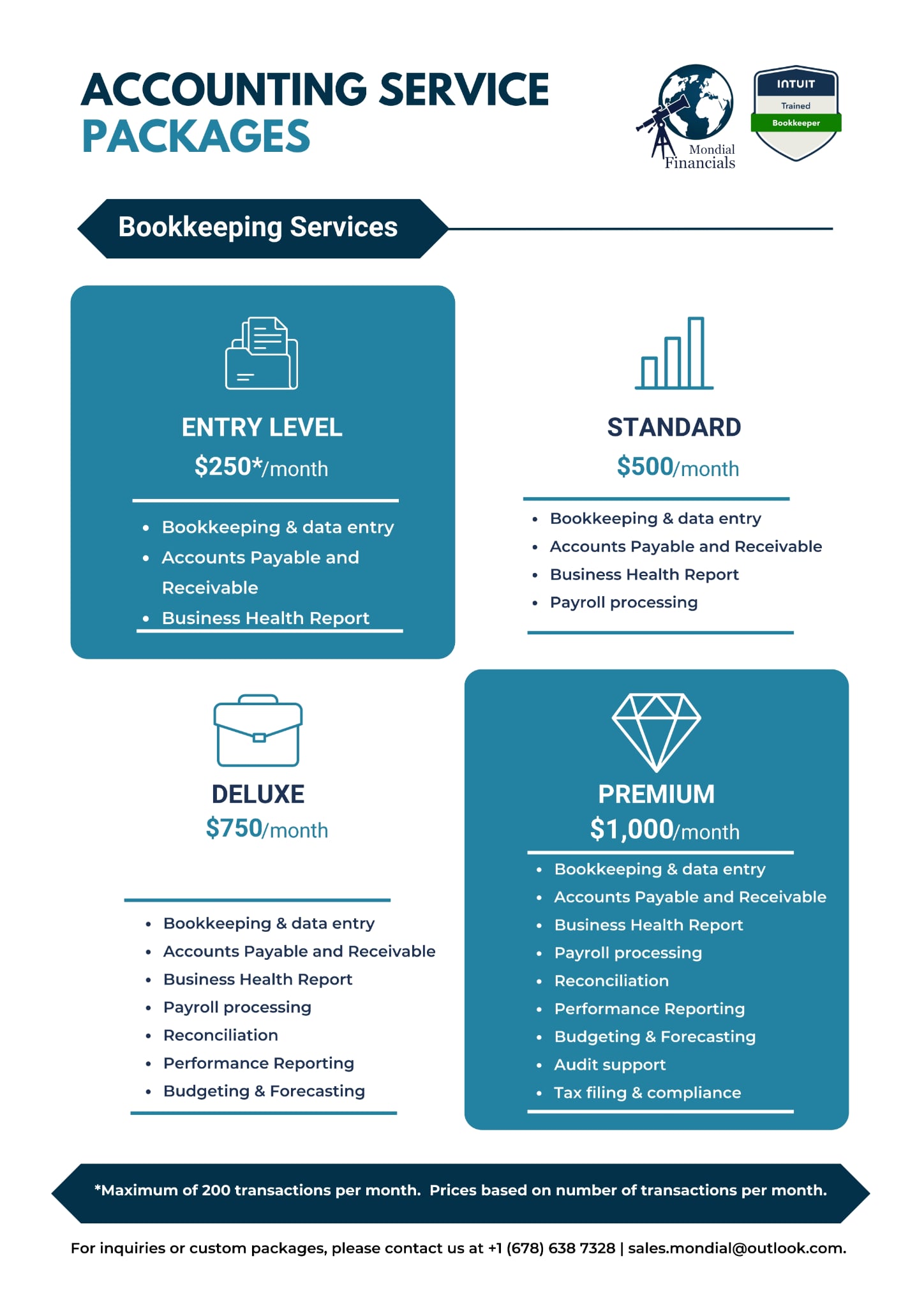

Our Scalable Package Options

Entry Level Package ($250/month): Perfect for startups and smaller operations, this package includes monthly bookkeeping, financial reports, and bank reconciliations: covering up to 100 transactions monthly.

Basic Package: Expands transaction capacity and reporting depth as your business grows.

Executive Package: Adds enhanced reporting, forecasting support, and strategic financial insights.

Premium Package ($1,000/month): Our most comprehensive offering includes everything from tax preparation support to audit assistance and performance reporting: ideal for businesses approaching $2M in revenue.

Every package includes human support you can reach when you have questions, not just automated software leaving you to figure things out alone. We combine the efficiency of modern bookkeeping tools with the expertise and personal touch your business deserves.

Take Control of Your Business Finances Today

Don't let bookkeeping mistakes hold your business back from reaching its full potential. Every month you spend wrestling with QuickBooks or sorting through receipts is time you could invest in growing your revenue, serving customers, or simply having a life outside work.

Professional outsourced bookkeeping isn't a luxury: it's a smart business investment that pays for itself through time savings, error prevention, and peace of mind.

Ready to eliminate these seven costly mistakes from your business? Start with our bookkeeping checkup to see exactly where your finances stand and how we can help. Your future self will thank you for taking this step today.

With Mondial Financials handling your bookkeeping, you can finally focus on what you do best: running and growing your business. Let's get started.

Comments